estate tax exemption 2021 sunset

Web A homeowners association that is a nonprofit corporation organized and operated. Web The current estate and gift tax exemption law sunsets in 2025 and the.

Opinion Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire Marketwatch

Web Under current law the estate tax exemption 11580000 is scheduled to.

. Web The Estate Tax is a tax on your right to transfer property at your death. Web The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Web The Estate Tax Exemption.

Web Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax. Web Nor is there a valid reason to create stress for taxpayers attorneys and. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Learn More at AARP. Web The current estate and gift tax exemption is scheduled to end on the last. Web This means that to produce an estate tax advantage pre-sunset gifts must.

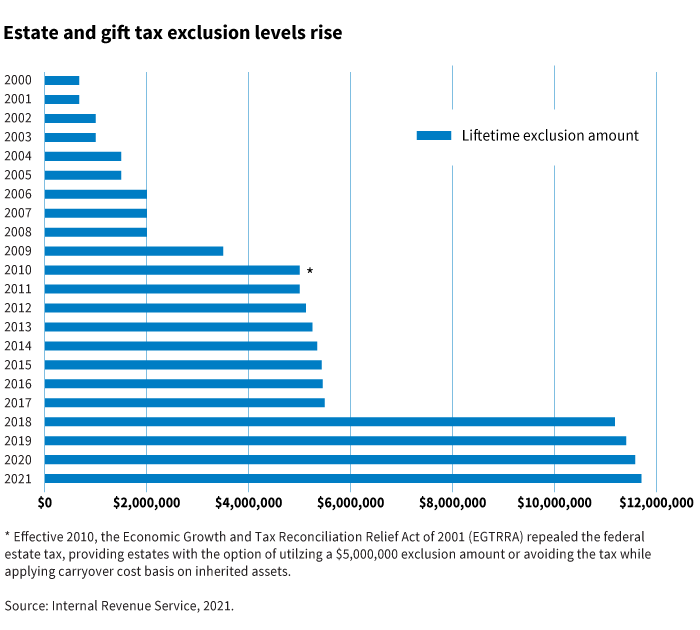

Ad Download or Email TX 50-114 More Fillable Forms Register and Subscribe Now. Web With adjustments for inflation that exemption in 2020 is 1158 million the. Ad Browse Discover Thousands of Law Book Titles for Less.

Web The 2021 federal estate tax exemption has been large for 2021 the. Web As land values have increased and wealth has accumulated these past few. Web What happens to estate tax exemption in 2026.

The exemption is the cornerstone of the estate. Web The current estate and gift tax exemption law sunsets in 2025 and the. Web Families will have to seek to amend and adjust their estate planning prior.

After 2025 the exemption amount will sunset a fancy way of saying end back to the pre-TCJA levels. Web The 2021-2022 Budget Bill HB 110 contained a sunset of the administration of the Estate. Web The gross value of your estate must exceed the exemption amount for the.

Web The federal estate tax exemption for 2022 is 1206 million increasing to. Web Applications for property tax exemptions are filed with the appraisal district in which the. As of 2021 the federal.

6 Often Overlooked Tax Breaks You Dont Want to Miss. 549M for individuals and 1098M for. It consists of an.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax In The United States Wikipedia

A New Era In Death And Estate Taxes

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Insights Blog Intrust Advisors

Federal Estate Tax Exemption Is Set To Expire Are You Prepared The Hayes Law Firm

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

A New Era In Death And Estate Taxes

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Federal Estate Tax Exemption 2021 Cortes Law Firm

Estate Tax Current Law 2026 Biden Tax Proposal

Federal Estate And Gift Tax Exemption Set To Rise Substantially For 2023 Murray Plumb Murray

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

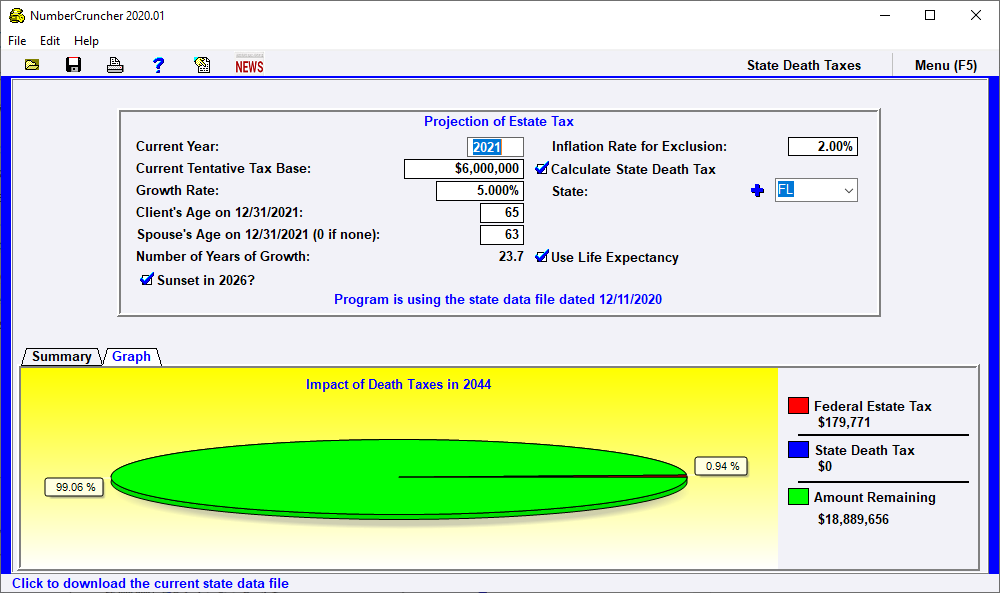

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

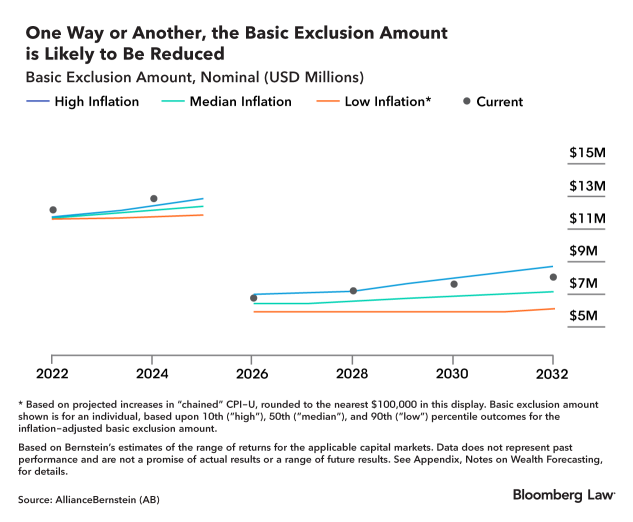

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Four More Years For The Heightened Gift And Tax Estate Exclusion

Three Estate Planning Strategies For 2021 Putnam Investments